Setting up your trading account

Setting up a crypto trading account involves a series of steps to ensure you’re ready to trade cryptocurrencies securely and compliantly. Here’s a detailed guide:

1) Choose a Cryptocurrency Exchange

• Research Platforms: Select a reputable exchange based on your needs. Popular options include Coinbase, Binance, Kraken, Bitfinex, and Gemini. Consider:

• Supported Coins: Ensure the exchange offers the cryptocurrencies you want to trade (e.g., Bitcoin, Ethereum, altcoins).

• Fees: Compare trading fees (maker/taker), deposit/withdrawal fees, and spread costs. For example, Coinbase charges about 1% per trade, while Binance offers lower fees (0.1% or less with BNB).

• Security: Look for platforms with strong security measures like two-factor authentication (2FA), cold storage, and insurance for hacks (e.g., Coinbase insures USD balances up to $250,000).

• Location Restrictions: Some exchanges restrict users from certain countries (e.g., Binance.US for U.S. residents).

• User Experience: Beginners may prefer user-friendly interfaces like Coinbase, while advanced traders might opt for Binance or Kraken for charting tools.

• Centralized vs. Decentralized: Centralized exchanges (CEX) like Coinbase or Binance, are easier for beginners but hold your funds. Decentralized exchanges (DEX) like Uniswap give you more control but require a crypto wallet and technical know-how.

2) Create an Account

• Sign Up: Visit the exchange’s website or download their app. Provide an email address and create a strong password (at least 12 characters, mixing letters, numbers, and symbols).

• Agree to Terms: Read and accept the platform’s terms of service and privacy policy.

• Enable 2FA: Immediately set up two-factor authentication (preferably using an authenticator app like Google Authenticator or Authy, not SMS) to secure your account.

3) Complete Identity Verification (KYC)

• Why It’s Needed: Most exchanges require Know Your Customer (KYC) verification to comply with anti-money laundering (AML) laws.

• Documents Required:

Government-issued ID (passport, driver’s license, or national ID).

• Proof of address (utility bill, bank statement, or lease agreement, typically dated within 3-6 months).

• Sometimes a selfie holding your ID or a specific code.

• Process: Upload clear images of documents through the exchange’s portal. Verification can take minutes (e.g., Coinbase) to days (e.g., Binance during high demand).

• Exceptions: Some DEXs or peer-to-peer platforms (e.g., LocalBitcoins in certain cases) may not require KYC, but they carry higher risks.

4) Deposit Funds

a)Fiat Deposits:

Link a bank account, debit/credit card, or use payment methods like PayPal (if supported).

•™Common methods: ACH transfer (U.S.), SEPA (Europe), or wire transfer.

b) Crypto Deposits:

• If you already own crypto, transfer it to your exchange wallet.

• Copy the exchange’s wallet address for the specific coin (e.g., BTC, ETH). Double-check the address to avoid losing funds.

• Be aware of network fees (e.g., Ethereum gas fees can be $5-$50 depending on congestion).

• Minimum Deposits: Some platforms have minimums (e.g., Kraken requires $10 for certain fiat deposits).

5) Learn the Trading Interface

Key Features:

• Order Book: Shows buy/sell orders and market depth.

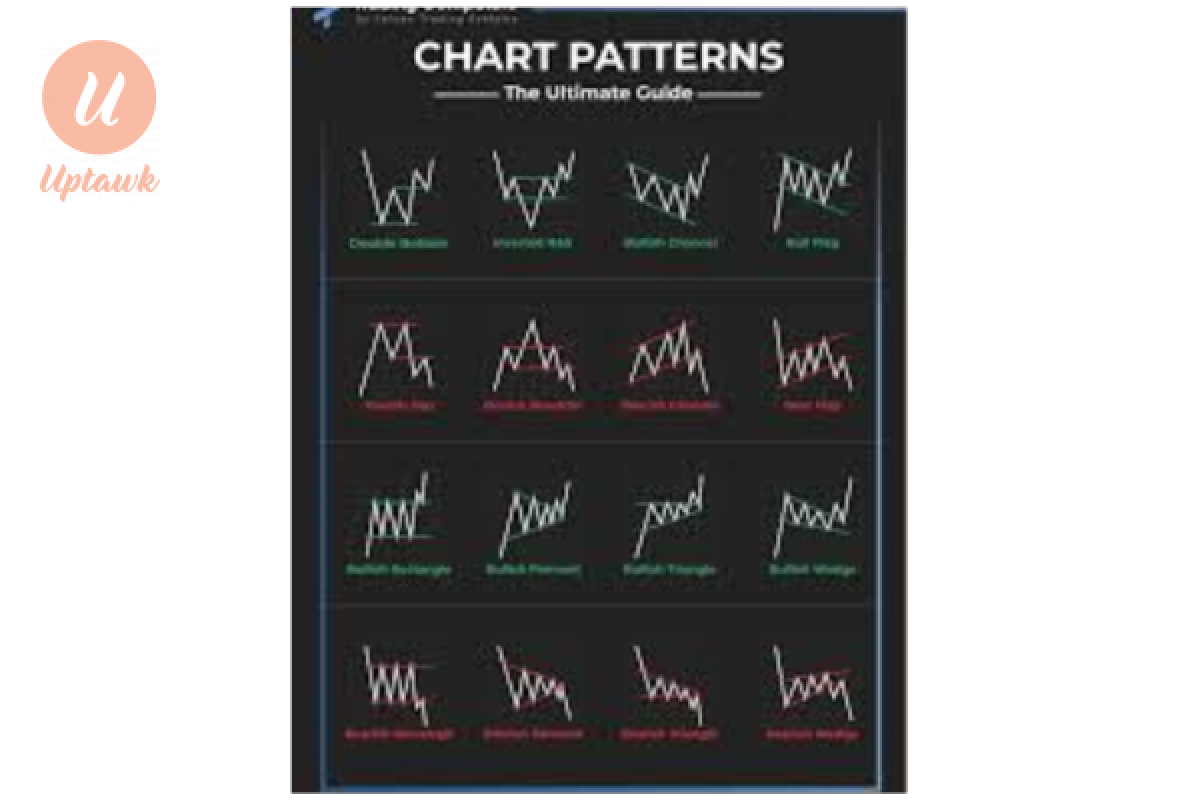

• Price Charts: Use candlestick charts and indicators (e.g., RSI, MACD) for technical analysis. Platforms like Binance integrate TradingView for advanced charting.

Order Types:

• Market Order: Buy/sell instantly at the current price.

• Limit Order: Set a specific price to buy/sell.

• Stop-Loss: Automatically sell if the price drops to a certain level to limit losses.

• Trading Pairs: Understand pairs like BTC/USD (trading Bitcoin for dollars) or ETH/BTC (trading Ethereum for Bitcoin).

• Practice: Many exchanges offer demo accounts or low-stake trades to learn without risking much.

6) Start Trading

Strategies:

• Day Trading: Buy/sell within a day to profit from short-term price movements.

• Swing Trading: Hold for days/weeks to capture larger trends.

• HODLing: Buy and hold long-term, ignoring short-term volatility.

Risk Management:

• Only invest what you can afford to lose (crypto is volatile; Bitcoin dropped 30% in a week in May 2021).

• Diversify across coins to reduce risk.

• Use stop-loss orders to protect against sudden crashes.

7) Stay Informed

• Market News: Follow crypto news on platforms like CoinDesk, CoinTelegraph, or X for real-time updates (e.g., regulatory changes, Elon Musk’s tweets impacting Dogecoin).

• Community: Join forums like Reddit’s r/cryptocurrency or Discord groups, but beware of scams and shilling.

• Education: Learn about blockchain, DeFi, and market trends to make informed decisions.

Comments 0 Comment