Forex Trading as a Business:

Transitioning from Retail Trader to Full-Time Trader

Forex trading, or foreign exchange trading, involves buying and selling currencies to profit from fluctuations in their exchange rates. While many start as retail traders—trading part-time with personal funds—transitioning to a full-time trader requires treating forex trading as a business. This shift demands a structured approach, discipline, and a mindset focused on sustainability and growth. Below, we’ll explore the key aspects of this transition, including developing a consistent trading edge, managing trading as a career, and creating multiple income streams in forex.

Transitioning from Retail Trader to Full-Time Trader

Moving from retail trading to a full-time career is a significant leap that involves both practical and psychological preparation. Here’s how to approach it:

• Financial Readiness

Capital Reserves: Full-time trading requires sufficient trading capital and personal savings. A common recommendation is to have at least 6-12 months of living expenses saved, separate from your trading account, to weather losses or drawdowns.

• Risk Management: Shift from speculative, high-risk trades to a conservative strategy. Protect your capital by risking only 1-2% of your account per trade.

• Time Commitment

As a retail trader, you might trade around a day job, but full-time trading means dedicating structured hours to market analysis, trade execution, and review. Treat it like a 9-to-5 job with defined schedules for research, trading, and learning.

• Mindset Shift

Retail traders often chase quick profits, while full-time traders focus on consistency and long-term profitability. Embrace losses as part of the business and avoid emotional decision-making.

• Business Plan

Develop a detailed trading plan outlining your goals, strategies, risk tolerance, and performance metrics. Treat losses as business expenses and profits as revenue, aiming for a positive return on investment (ROI) over time.

• Identify Your Strategy

Choose a trading style that suits your personality and schedule: scalping (short-term), day trading, swing trading, or position trading (long-term).

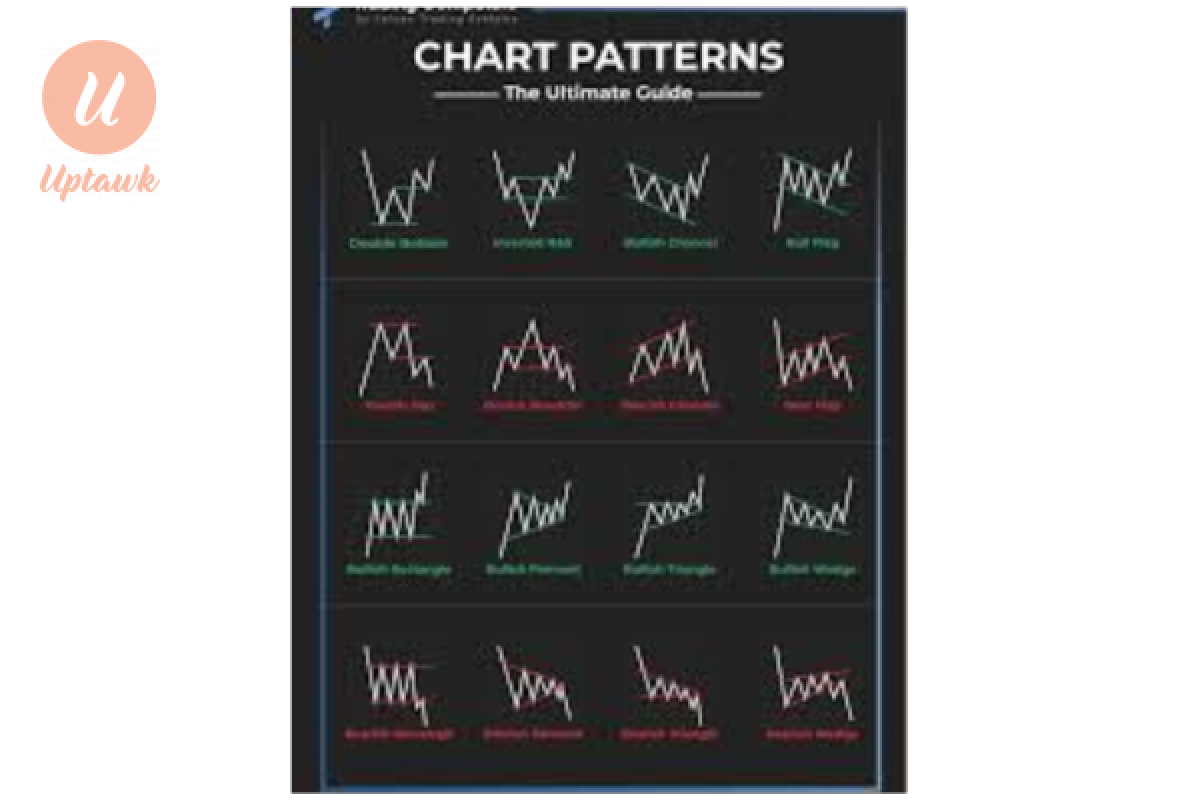

Base your edge on technical analysis (e.g., chart patterns, indicators like RSI or moving averages), fundamental analysis (e.g., interest rates, economic data), or a hybrid approach.

• Backtesting and Optimization

Test your strategy on historical data to verify its profitability. Use platforms like MetaTrader or TradingView to simulate trades and calculate win rates, risk-reward ratios, and drawdowns.

Refine your strategy by adjusting variables (e.g., entry/exit points, stop-loss levels) to maximize performance.

• Discipline and Execution

Stick to your rules religiously. A consistent edge fails if you deviate due to greed, fear, or overtrading. Automate parts of your strategy (e.g., via Expert Advisors) if discipline is a challenge.

• Performance Tracking

Maintain a trading journal to log every trade, including entry/exit points, profit/loss, and emotional state. Analyze this data weekly or monthly to identify strengths and weaknesses in your edge.

Conclusion

Treating forex trading as a business involves a holistic transformation—from honing a consistent edge to managing it as a career and diversifying income. The transition from retail to full-time trader requires capital, discipline, and a professional mindset. By developing a robust strategy, maintaining strict risk management, and exploring additional revenue streams like education or fund management, you can build a sustainable forex business. Success lies in consistency, adaptability, and treating losses as learning opportunities rather than setbacks. With the right approach, forex trading can evolve from a hobby into a thriving career.

Comments 0 Comment